اكتشف وتداول في أسواق العقود مقابل الفروقات

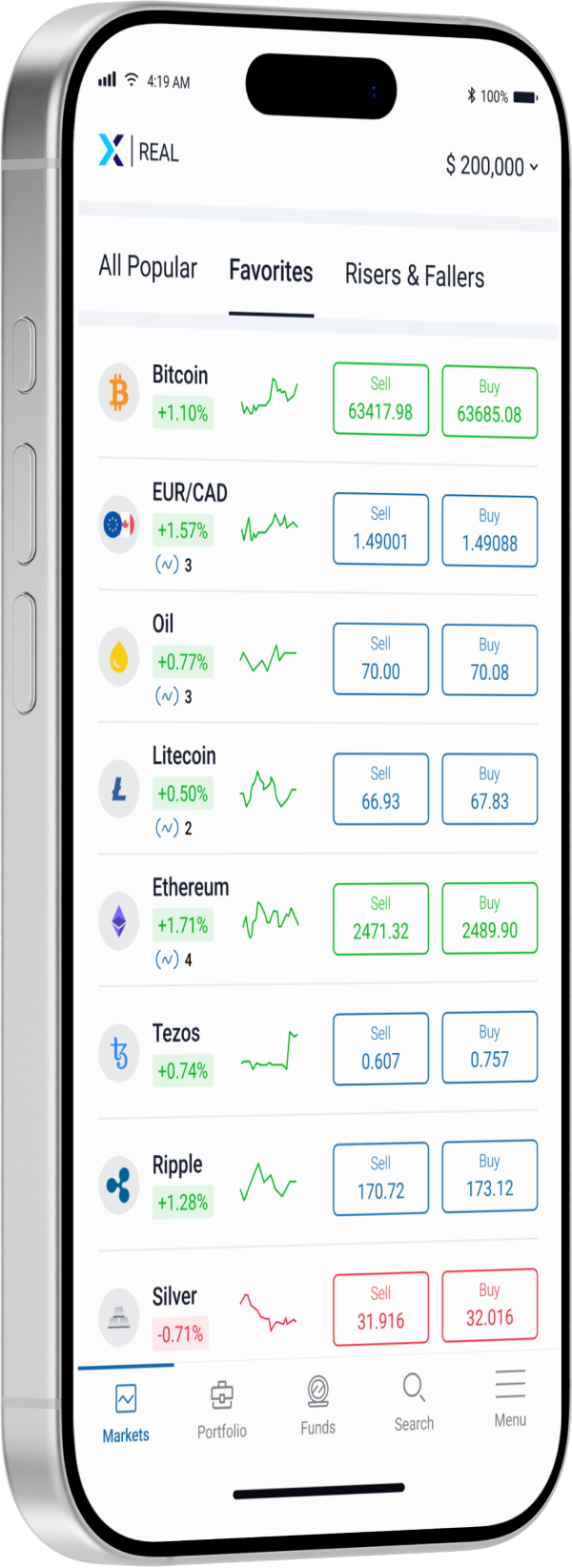

افتح الأبواب أمام إمكانيات أكبر أسواق التداول الإلكتروني في العالم لتداول الفوركس، السلع، المؤشرات، العملات المشفرة، السندات، صناديق التبادل المتداولة وعقود الأسهم مقابل الفروقات. استفد من الفروقات التنافسية، وتنفيذ الأوامر السريع، والعمولات الموفرة من أجل استثمارات مُحسّنة.

منطقة

Aurora Cannabis

ACB

$

%

Constellation Brands

STZ

$

%

Cronos Group Inc

CRON

$

%

Tilray

TLRY

$

%

Abbott Laboratories

ABT

$

%

AbbVie

ABBV

$

%

Adobe Systems

ADBE

$

%

AIG

AIG

$

%

Airbnb

ABNB

$

%

Alibaba

BABA

$

%

Aurora Cannabis

ACB

$

%

Constellation Brands

STZ

$

%

Cronos Group Inc

CRON

$

%

#تداول_العقود_مقابل_الفروقات

حول العقود مقابل الفروقات

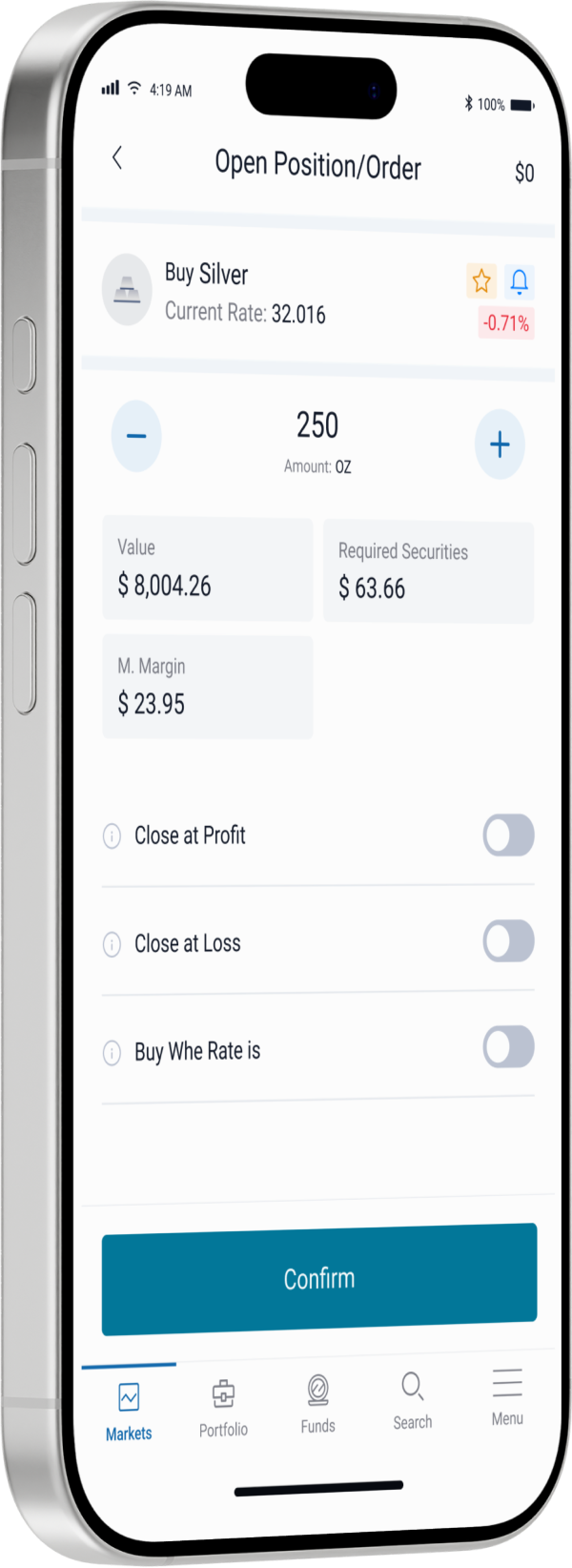

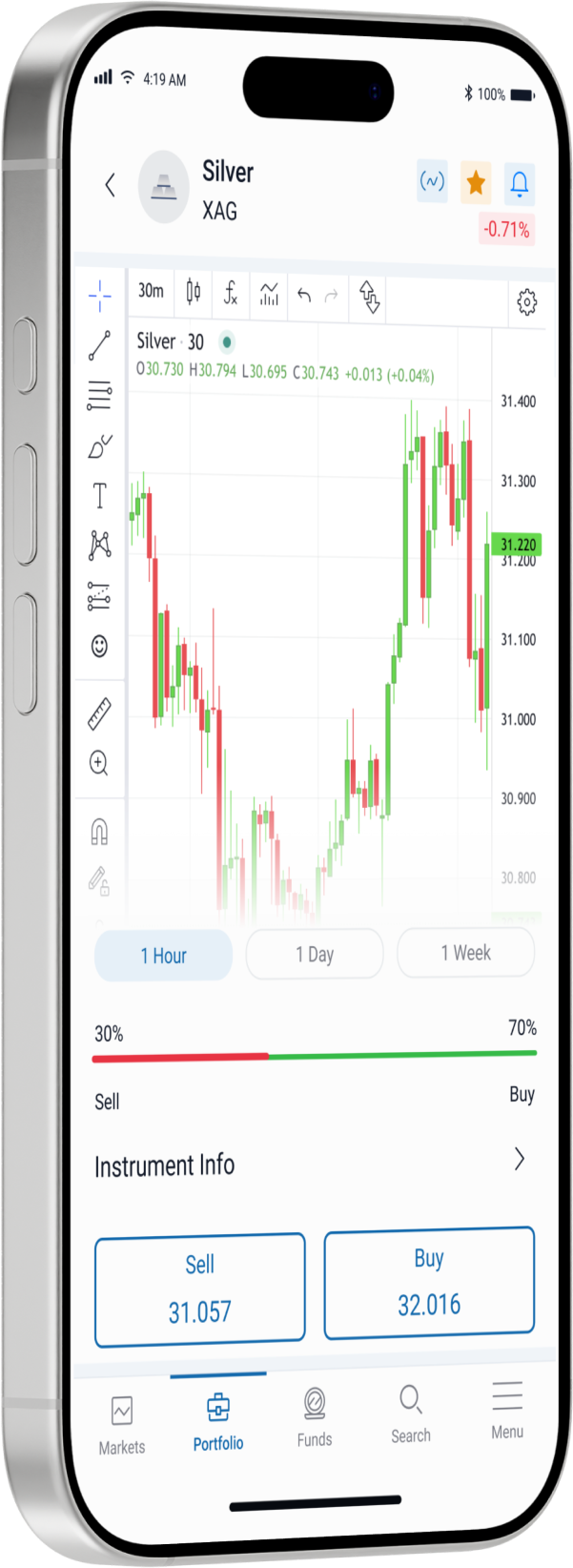

العقود مقابل الفروقات هي أدوات مالية تسمح للمتداولين بالمضاربة على تحركات الأسعار دون امتلاك الأصول الأساسية. تشمل فوائد تداول العقود مقابل الفروقات الاستفادة من تقلبات السوق، والاستفادة من الاستثمارات لتحقيق عوائد محتملة أعلى، والوصول إلى الأسواق المالية المتنوعة.

- أكثر من 400 أداة تداول

- تنفيذ فائق السرعة

- حماية من الرصيد السلبي

مكتبة تعليم التداول

دليل شامل للتداول المحترف

قم بتعزيز مهارات التداول الخاصة بك مع مصادر تعليمية شاملة. قم بالوصول إلى دروس تعليمية وندوات ودورات تم تصميمها خصيصًا لأسلوب تعلمك. اتقن التحليل الفني والأساسي، وإدارة المخاطر، واستراتيجيات التداول الفعّالة. حقق أهداف التداول الخاصة بك بثقة.

#التفوقالتنافسي

لماذا نستثمر معنا؟