اكتشف وتداول عقود السلع الفورية

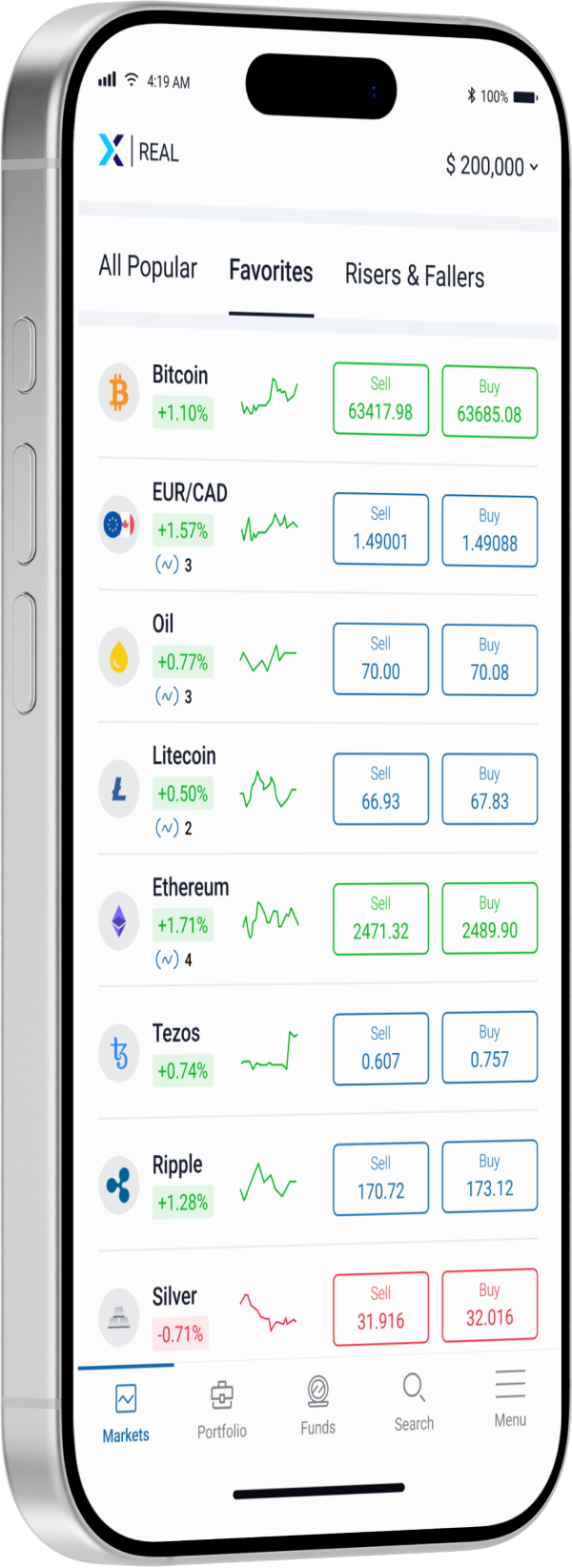

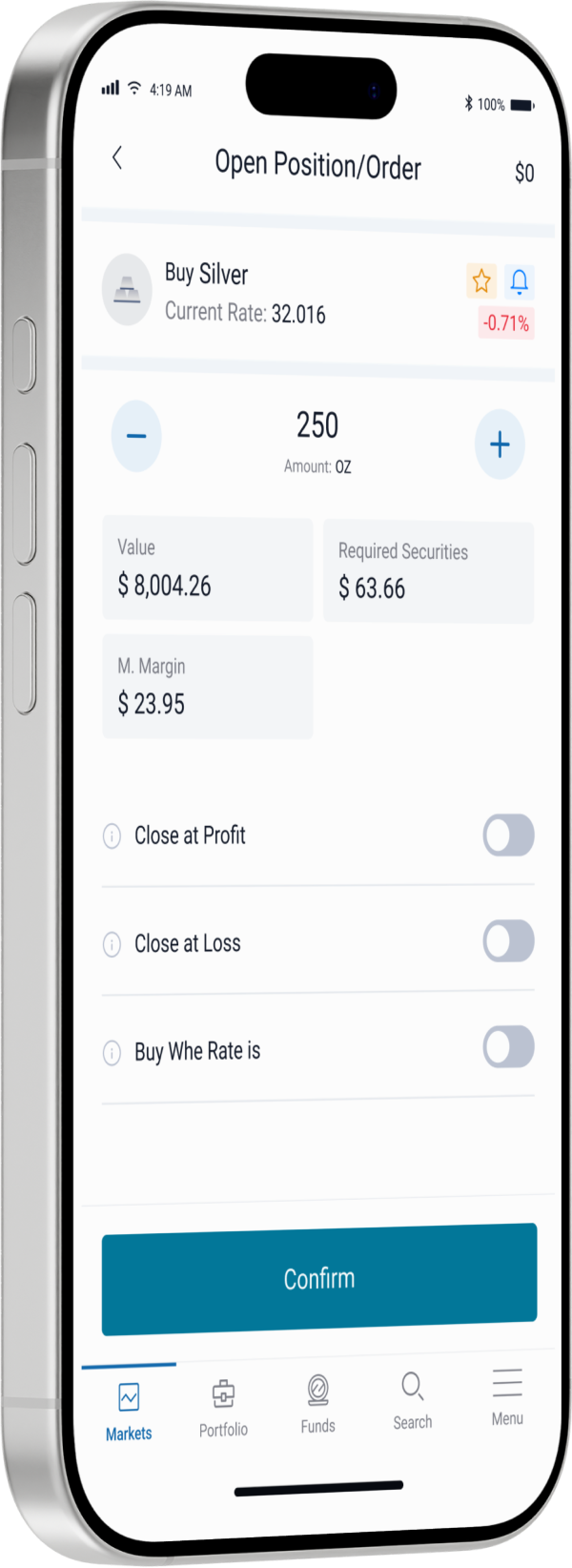

يمكنك الوصول إلى مجموعة واسعة من السلع المرغوبة مثل الذهب والنفط والفضة وغيرها بسهولة. في XTrade، استمتع بسهولة تداول السلع المشابهة لأزواج العملات، بدون معاملات فعلية أو ملكية.

السلع الشعبية

Gold/USD

XAU

$

%

Gold/USD gram

XAUUSDGRAM

$

%

Gold/EUR

XAUEUR

$

%

Gold/CNY

XAUCNY

$

%

Gold/CNY gram

XAUCNYGRAM

$

%

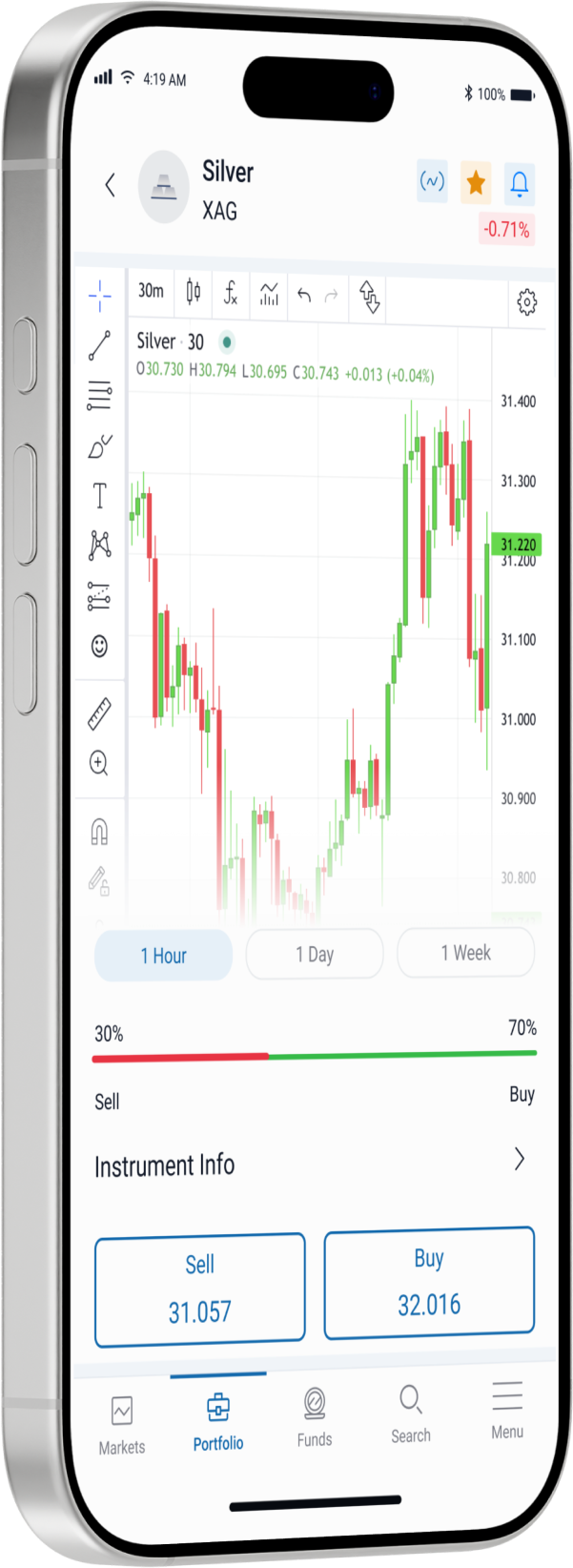

Silver

XAG

$

%

Oil

CL

$

%

Oil Cash

XTIUSD

$

%

Brent Oil

EB

$

%

Natural Gas

NG

$

%

Gold/USD

XAU

$

%

Gold/USD gram

XAUUSDGRAM

$

%

Gold/EUR

XAUEUR

$

%

#تداول_السلع

عن عقود السلع الفورية

تمثل السلع، مثل الأصول المادية، المواد الخام التي يمكن شراؤها أو بيعها. تمامًا مثل العملات، توفر الأسواق المالية الفرصة لتداول السلع مثل الطاقة والمعادن من خلال عقود الفروقات. مع توفر السيولة الكبيرة، توفر السلع الأساسية للمستثمرين فرصًا قيمة لتنويع محافظهم الاستثمارية واغتنام فرص تجارية فريدة من نوعها.

مكتبة تعليم التداول

دليل شامل للتداول المحترف

قم بتعزيز مهارات التداول الخاصة بك مع مصادر تعليمية شاملة. قم بالوصول إلى دروس تعليمية وندوات ودورات تم تصميمها خصيصًا لأسلوب تعلمك. اتقن التحليل الفني والأساسي، وإدارة المخاطر، واستراتيجيات التداول الفعّالة. حقق أهداف التداول الخاصة بك بثقة.

#التفوقالتنافسي

لماذا نستثمر معنا؟