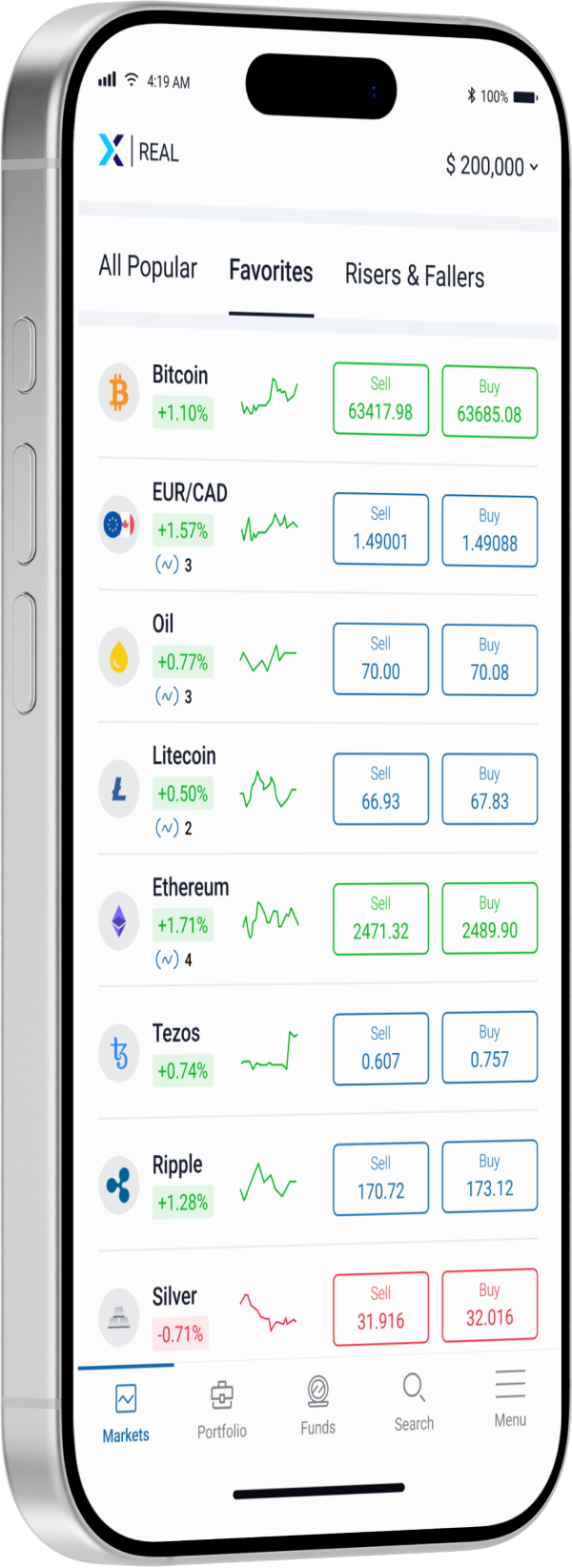

اكتشف وتداول عقود الاختلاف لصناديق التداول المتداولة

تداول صناديق التداول المتداولة الشهيرة مع وسيط موثوق للحصول على فروق أسعار تنافسية، وتنفيذ سريع، وعمولات منخفضة.

إتفس الشعبية

USO-Oil Fund

USO

$

%

Direxion Daily Gold Miners

NUGT

$

%

Bitwise Crypto Industry Innovators

BITQ

$

%

Vanguard Value Index

VTV

$

%

ProShares UltraPro

TQQQ

$

%

Ultra VIX Short-Term Futures

UVXY

$

%

MSCI Brazil

EWZ

$

%

Direxion Small Cap Bear

TZA

$

%

UltraPro Short QQQ

SQQQ

$

%

UltraShort S&P500

SDS

$

%

USO-Oil Fund

USO

$

%

Direxion Daily Gold Miners

NUGT

$

%

Bitwise Crypto Industry Inno...

BITQ

$

%

#تداول_صناديق_التداول_المتداولة

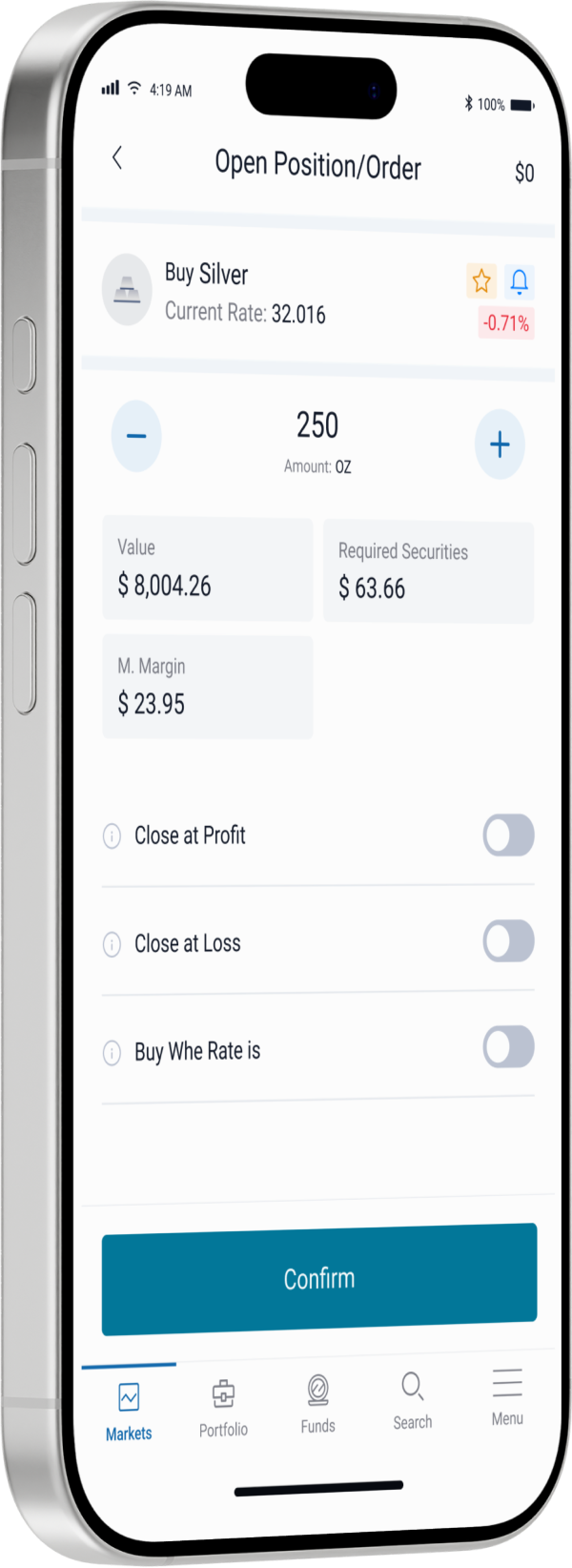

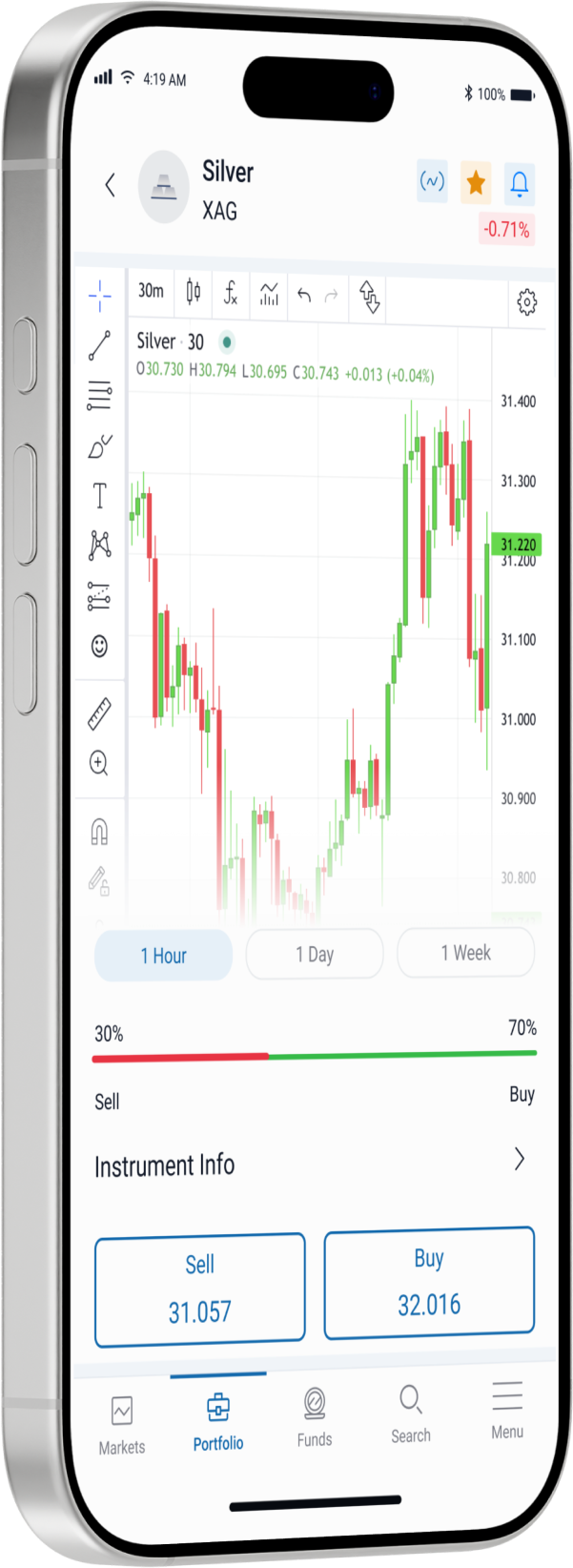

عن عقود الاختلاف لصناديق التداول المتداولة

صناديق الاستثمار المتداولة هي صناديق استثمار متداولة توفر تعرضًا متنوعًا لمؤشرات أو قطاعات أو سلع أو فئات أصول محددة. فهي تسمح للمستثمرين بالاستثمار بشكل غير مباشر في مجموعة متنوعة من الأصول، مثل الأسهم أو السندات أو السلع، من خلال معاملة واحدة، مما يلغي الحاجة إلى عمليات شراء الأوراق المالية الفردية. تداول صناديق الاستثمار المتداولة مع عقود الفروقات للمضاربة على الأسعار دون امتلاك الأصول. استمتع بمزايا السيولة والشفافية والفعالية من حيث التكلفة التي توفرها صناديق الاستثمار المتداولة مقارنة بصناديق الاستثمار المشتركة.

مكتبة تعليم التداول

دليل شامل للتداول المحترف

قم بتعزيز مهارات التداول الخاصة بك مع مصادر تعليمية شاملة. قم بالوصول إلى دروس تعليمية وندوات ودورات تم تصميمها خصيصًا لأسلوب تعلمك. اتقن التحليل الفني والأساسي، وإدارة المخاطر، واستراتيجيات التداول الفعّالة. حقق أهداف التداول الخاصة بك بثقة.

#التفوقالتنافسي

لماذا نستثمر معنا؟