اكتشف وتداول عقود الفروقات على الأسهم

استكشف مجموعة متنوعة من عقود الفروقات على الأسهم الدولية وقم بتوسيع محفظتك بينما تستمتع بالعمولات المنخفضة.

منطقة

Aurora Cannabis

ACB

$

%

Constellation Brands

STZ

$

%

Cronos Group Inc

CRON

$

%

Tilray

TLRY

$

%

Abbott Laboratories

ABT

$

%

AbbVie

ABBV

$

%

Adobe Systems

ADBE

$

%

AIG

AIG

$

%

Airbnb

ABNB

$

%

Alibaba

BABA

$

%

Aurora Cannabis

ACB

$

%

Constellation Brands

STZ

$

%

Cronos Group Inc

CRON

$

%

#تداول الاسهم

حول أسهم العقود مقابل الفروقات

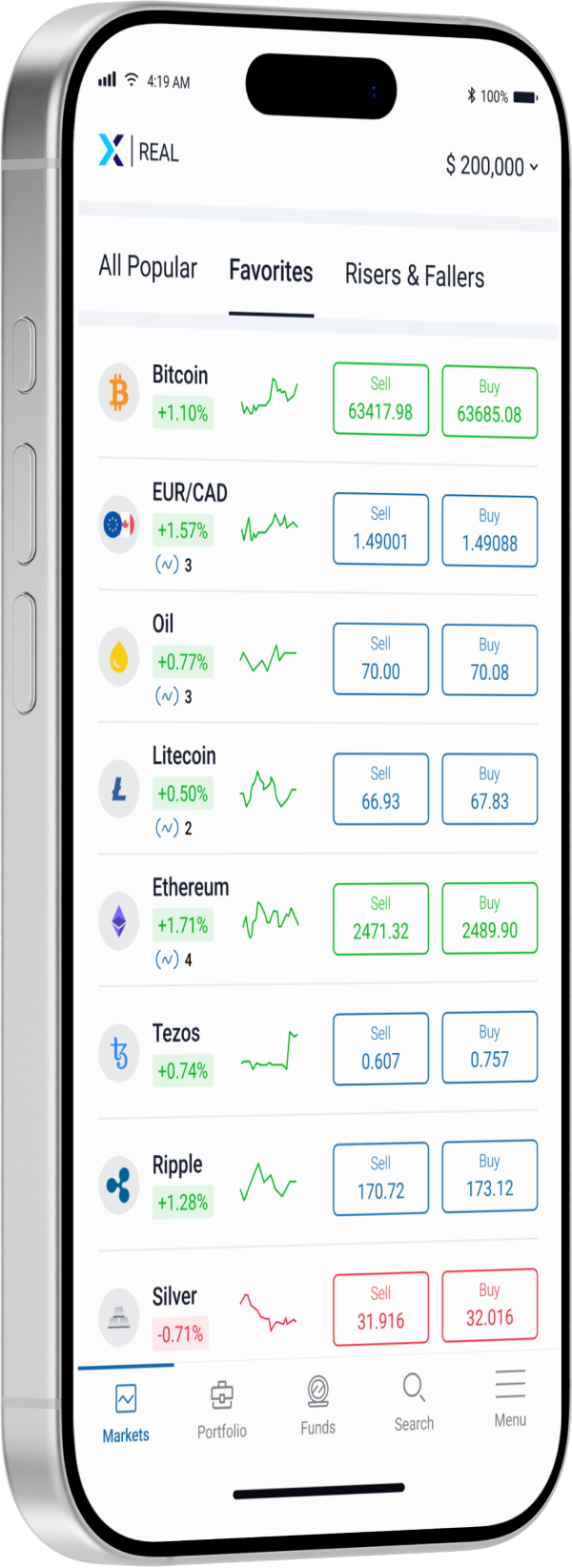

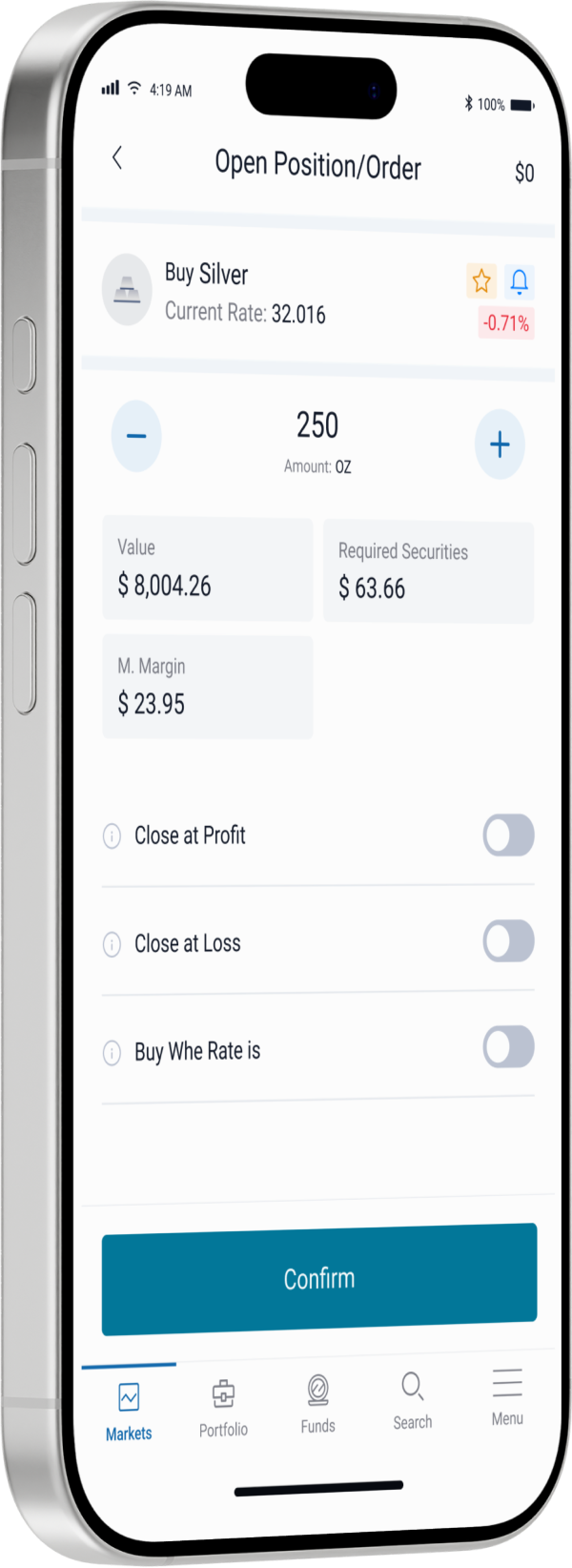

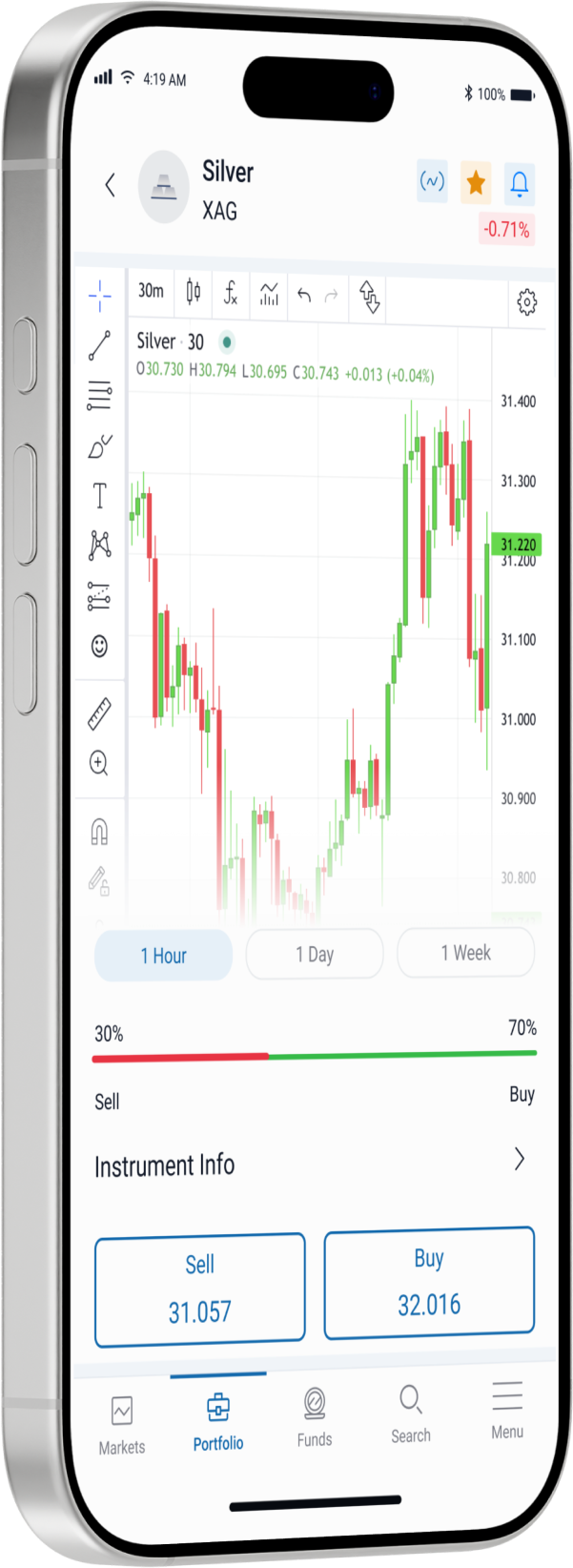

في عالم تداول الأسهم، ينخرط الأفراد في شراء وبيع الأسهم في أصول أو شركات محددة. يكتسب المتداولون الأسهم ويحتفظون بملكيتها ويتخذون القرارات بشأن وقت بيعها استنادًا إلى القيمة السوقية للأسهم. في XTrade، يتم تداول الأسهم حصريًا من خلال عقود الفروقات، مما يسمح بالمشاركة في تقلبات الأسعار دون امتلاك أسهم فعلية . في تداول أسهم العقود مقابل الفروقات، يمكنك الربح من الحركات الصعودية مع مركز طويل أو من الحركات الهبوطية مع مركز قصير.

مكتبة تعليم التداول

دليل شامل للتداول المحترف

قم بتعزيز مهارات التداول الخاصة بك مع مصادر تعليمية شاملة. قم بالوصول إلى دروس تعليمية وندوات ودورات تم تصميمها خصيصًا لأسلوب تعلمك. اتقن التحليل الفني والأساسي، وإدارة المخاطر، واستراتيجيات التداول الفعّالة. حقق أهداف التداول الخاصة بك بثقة.

#التفوقالتنافسي

لماذا نستثمر معنا؟