كيف تبدأ؟

بدء رحلتك الاستثمارية. خطوات بسيطة لبدء بناء مستقبلك المالي.

التسجيل

خذ لحظة لإكمال نموذج الطلب القائم على الويب، شارك تفاصيل عن نفسك، خلفيتك المالية، وأرفق نسخة من وثيقة هويتك.

التمويل

اختر من بين مجموعة متنوعة من طرق الدفع، كل منها يقدم رسوم إيداع 0 لراحتك.

التداول

استكشف مجموعة متنوعة من أدوات عقود الفروقات للتداول عبر الإنترنت في الفوركس، السلع، المؤشرات، العملات الرقمية، السندات، صناديق الاستثمار المتداولة وعقود الفروقات للأسهم.

#تطبيق_الجوال

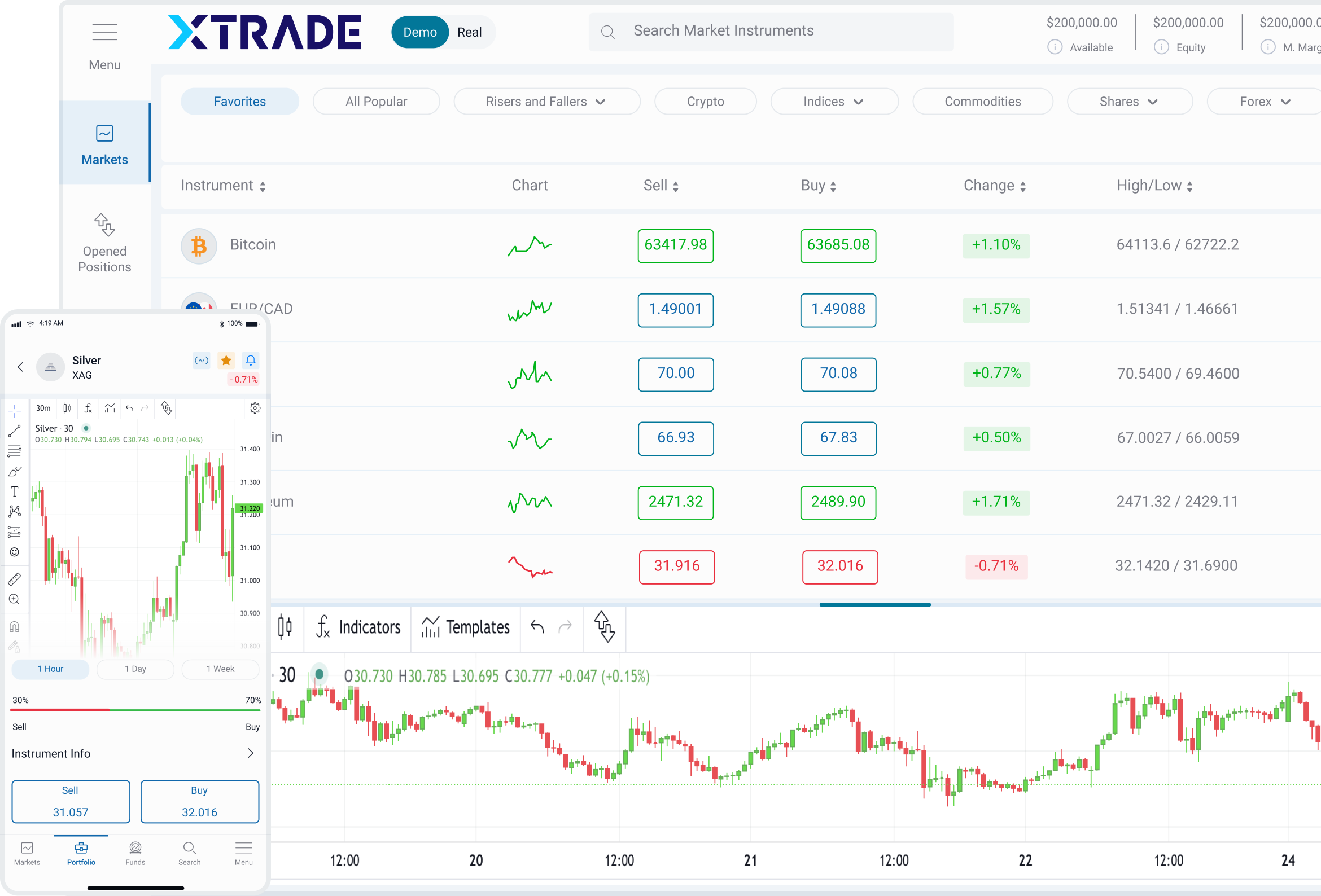

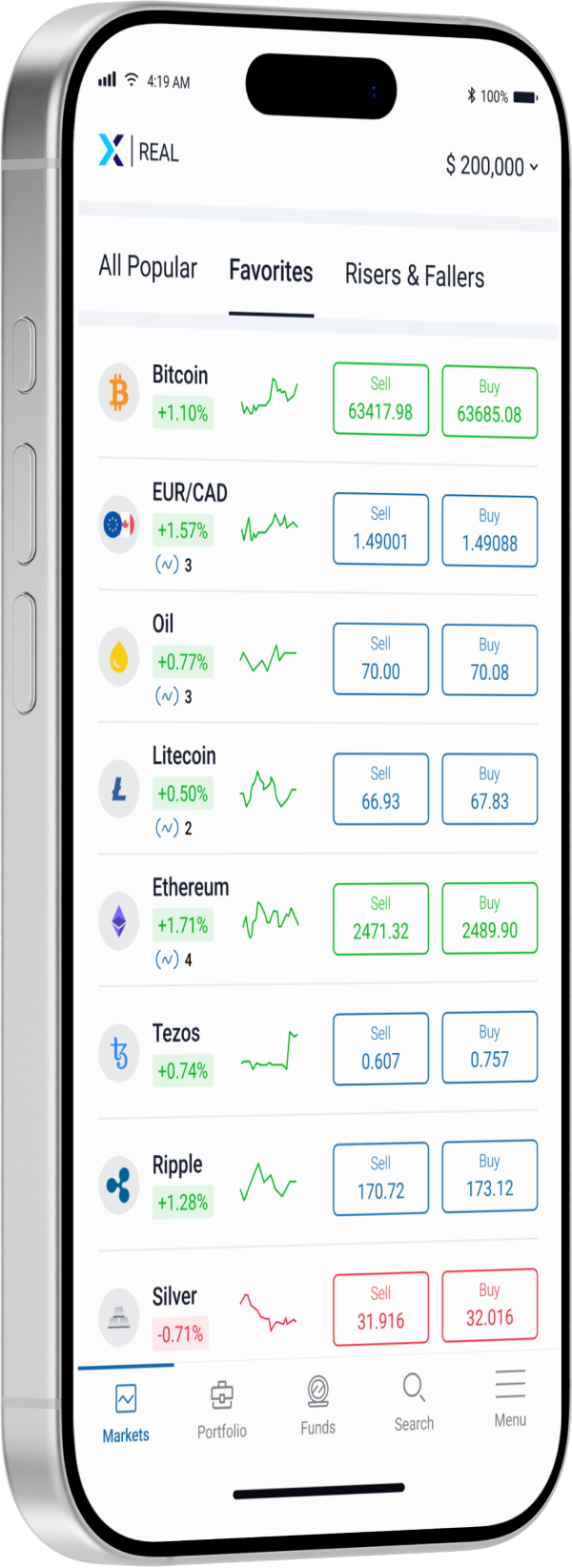

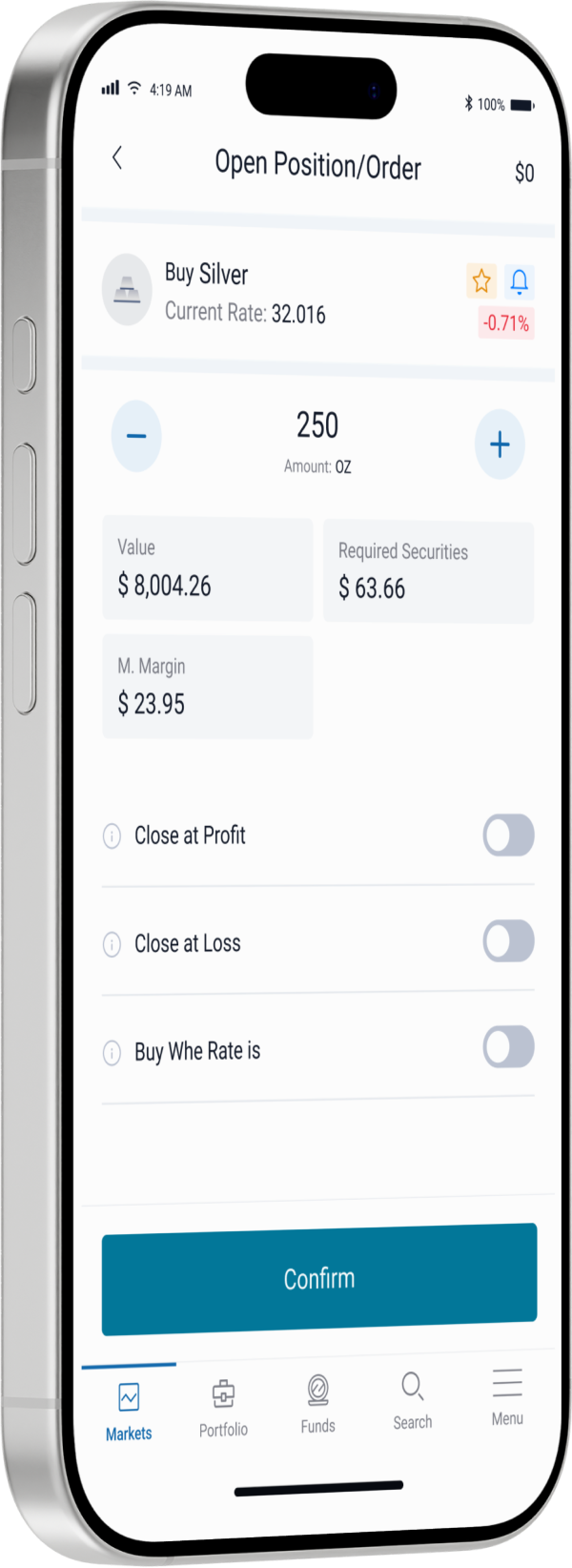

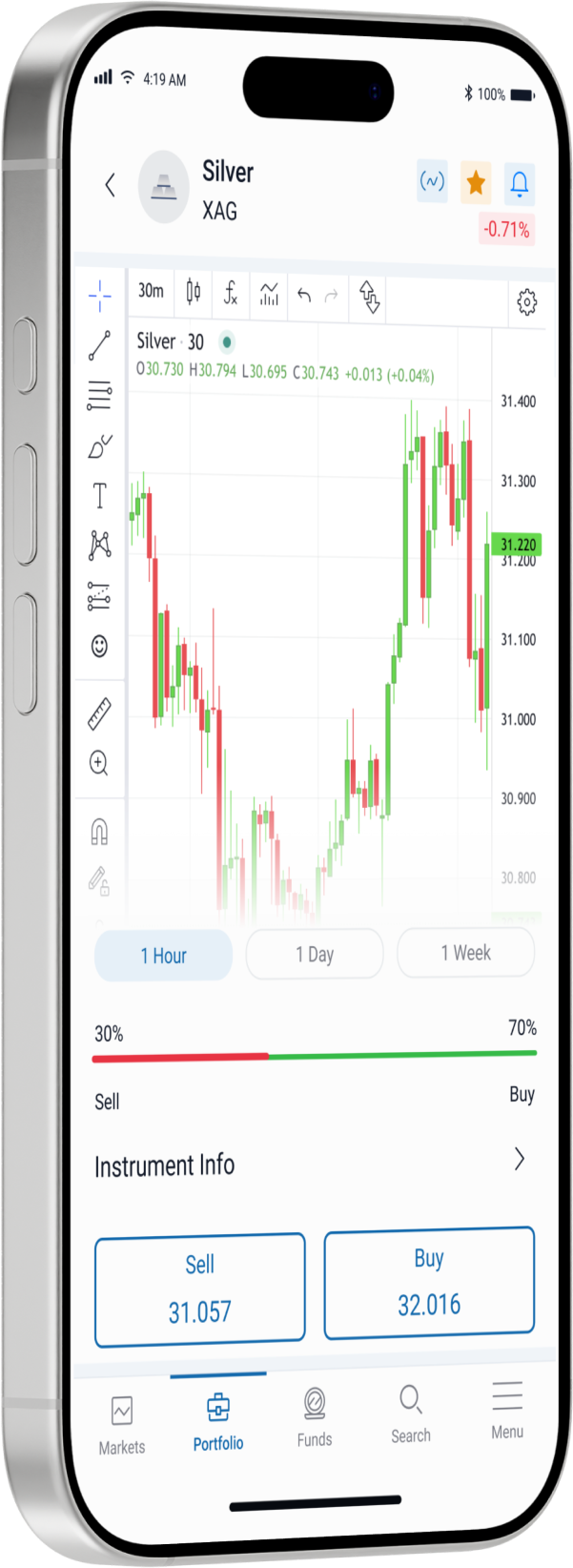

تداول مع منصة الجوال XTrade

ابق على اتصال بالأسواق في جميع الأوقات من خلال منصة XTrade القوية للجوال، والتي يمكن الوصول إليها على أجهزة iOS وAndroid. استفد من الرسوم البيانية في الوقت الفعلي، وراقب مراكزك المفتوحة، وقم بسهولة بتعيين مستويات جني الأرباح التي تريدها، كل ذلك مع الاستمتاع بمجموعة واسعة من أدوات التداول القوية.

📈 جرب التطبيق مجانًا (€0.00)

مكتبة تعليم التداول

دليل شامل للتداول المحترف

قم بتعزيز مهارات التداول الخاصة بك مع مصادر تعليمية شاملة. قم بالوصول إلى دروس تعليمية وندوات ودورات تم تصميمها خصيصًا لأسلوب تعلمك. اتقن التحليل الفني والأساسي، وإدارة المخاطر، واستراتيجيات التداول الفعّالة. حقق أهداف التداول الخاصة بك بثقة.

#التفوقالتنافسي

لماذا نستثمر معنا؟